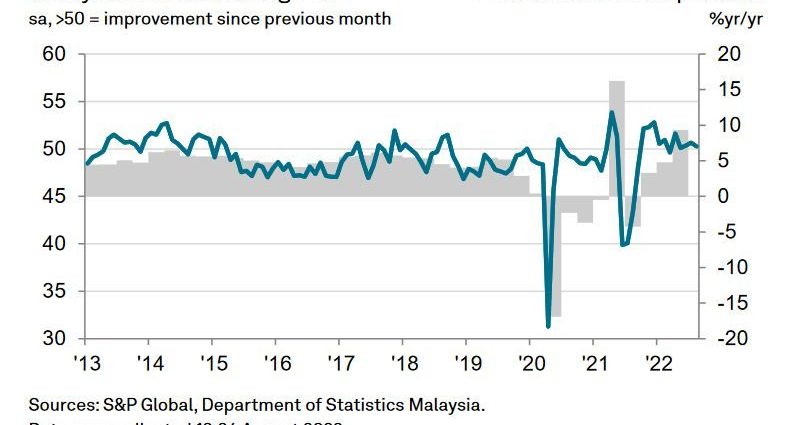

KUALA LUMPUR: The seasonally adjusted S&P Global Malaysia manufacturing purchasing managers’ index (PMI) slipped to 50.3 in August from 50.6 in July, indicating a softer improvement in the health of the sector.

The latest reading is representative of a gradual slowdown in the growth of manufacturing production and gross domestic product (GDP) towards the end of the third quarter, following sustained rises throughout the second quarter of the year.

“The Malaysian manufacturing sector reported improved business conditions for the tenth time in the past 11 months during August, though clearly remains under pressure from raw material and labour shortages, rising prices and weak demand, notably from overseas,” S&P Global Market Intelligence chief business economist Chris Williamson said in a statement.

He said fortunately, there are signs that supply constraints are starting to ease and price pressures are also abating.

“Similarly, despite falling export demand, August saw new orders rising at a slightly increased rate, which should feed through to improved production growth in September; something which is supported by the brighter outlook indicated by the lifting of business optimism to a seven-month high,” he added.

S&P Global said Malaysia’s manufacturing sector reported a moderation in growth momentum midway through the third quarter of 2022.

While output levels were scaled back for the first time in three months, incoming orders continued to improve and registered the strongest rise since April, though the rate of growth was still only mild.

Firms often commented that global economic weaknesses, supply chain disruption and labour shortages had weighed on operating conditions, although there were signs that delivery delays eased in August.

In addition, it said the time taken to receive inputs lengthened to the least extent since January 2020, in turn easing price pressures.

As a result, input prices rose at a slower, albeit still marked, pace that was the softest for 11 months. Manufacturers were increasingly confident regarding future output, with sentiment rising to the highest since January.

S&P Global said the softer headline figure was largely due to a renewed moderation in output volumes that was the first since May.

That said, the rate of reduction was only fractional. Firms commonly attributed muted production to difficulty receiving inputs amid sustained delivery delays, though these were not as severe as in previous months.

On the price front, input costs increased for the twenty-seventh month running in August, reflecting higher raw material and transportation prices.

Positively, the rate of inflation eased for the second successive month to reach the lowest since September 2021, as firms reported lower prices for a wide variety of inputs, most notably including oil.

Manufacturers partially passed these savings through to clients, as output charges increased at the softest rate for 12 months.

Looking ahead, Malaysian manufacturers remained optimistic regarding the year-ahead outlook for output amid hopes demand conditions would continue to improve as the pandemic was brought fully under control.

The overall level of confidence rose to a seven-month high as a result.