The double-digit fall was the industry’s biggest one day defeat since the 1987 Black Monday accident.

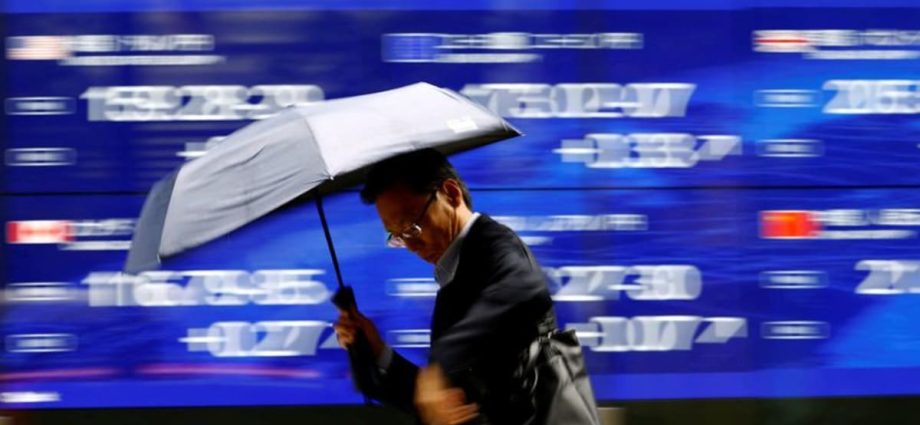

Fears of a US recession risk and the unwinding of investments funded by a cheap yen caused stress in the market, and the Bank of Japan’s ( BOJ) hawkish attitude last week sparked concern about how quickly the central bank would tighten monetary policy.

Shinichi Uchida, the governor’s deputy, addressed those concerns on Wednesday, saying the BOJ wo n’t increase rates in times of uncertainty.

In a statement to business leaders in the city of Hakodate in northern Japan, Uchida said,” It’s necessary to maintain current levels of monetary easing for the time being” as we witness strong uncertainty in both domestic and international economic areas.

Market participants are keeping an eye on improvements, but comments from Federal Reserve authorities this week and more economic data have eased some concerns about a US recession.

According to Morgan Stanley MUFG experts,” the biggest problem in the markets back will be whether concerns about a US recession will subside,” making them for the time being especially sensitive to inflation and job data.

The japanese recovered from its seven-month top hit at the start of the week on Tuesday, but it has since risen from the lows of the previous session.

The broader Topix was up 2.79 per share.