Huawei Technologies, the Shenzhen-based telecommunication devices maker, has introduced a change in business strategy to focus more on the bottom line than generating revenue right after its net margin declined by almost 50% in the first half of 2022 compared to the same period last year.

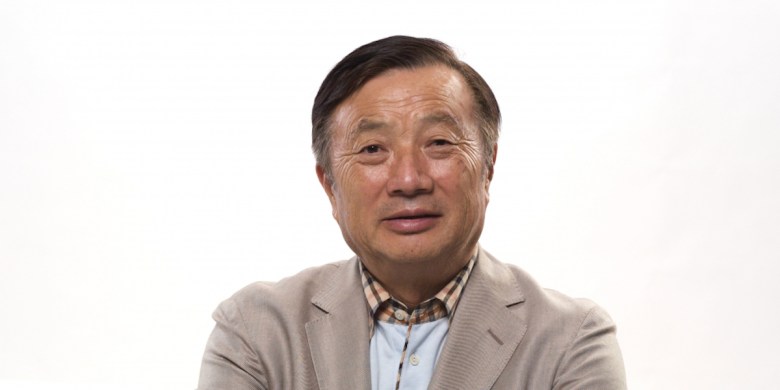

Huawei’s originator, Chief Executive Ren Zhengfei, wrote in an internal memo that the technology giant would turn off or reduce its unprofitable businesses and focus more on its high-value lines in the coming few years.

Employees would get more bonuses or promotions if they could help the organization boost operating profits – less therefore , sales – based on the memo obtained by Chinese news media.

Ren said:

The continued recession of the global economic climate, together with the impact from the Covid-19 epidemic, may greatly hurt people’s consumption power. We face not only stress on supply but also a weakening market demand. Between 2023 and 2025, we should make survival the main goal. We must remain alive and live with quality. From this perspective, we need to adjust our business strategy plus decide what can be done and exactly what should be abandoned … With survival the main principle, marginal companies will be shruken and closed. The chill will be felt simply by everyone.

The company mentioned its net margin was 5% in the first six months of the year, compared with nine. 8% in the same period of last year. It indicates Huawei’s net revenue fell by fifty-one. 97% to fifteen. 1 billion yuan for the period.

Commentators said Huawei saw declining success because its smartphone business had been hit by the United States’ sanctions since 2019. They said the company should downsize its e-vehicle business as its comes back were less than expected.

The memo

Ren published the memo, titled “Huawei must shift to seek for profit and cash flow through boosting revenue” within the company’s online dialogue group earlier recently.

He mentioned Huawei must stop expanding or investing blindly, have the dedication to downsize and give up some nationwide tasks, replenish income to get ready for a worsening future, cut off risky and non-profitable companies, grant bonuses to employees by their actual business results and increase inventory.

“Our respite period is 2023 and 2024. We are not sure whether we can achieve any innovations these two years, ” Ren said. “Therefore, everyone should not present concepts but talk about reality, particularly in business forecasting. ”

“Whoever composed stories and scammed for funding are going to pay for the losses, ” he told employees in the memo. “Only if we can remain alive, can we have a future. ”

He added that will some strategic companies, such as internet-related units, might be able to go on but a lot of barely-surviving businesses had to be terminated. He said Huawei would improve its research and development (R& D) and modularize its products to boost competition.

Some commentators said Huawei did not have to make the whole clever car and should concentrate on some core high-value modules. They said it is the right decision for your company to focus on cellular OS, semiconductor design and emerging sectors such as smart cities and data centers but it would take the time to see big outcomes.

Since 2019, Huawei has partnered based on a Chinese automakers. At first, it worked with Seres, a California-based e-vehicle maker owned with the Chongqing Sokon Market Group, to produce a sports activities utility vehicle (SUV) called SF5. During that time, Huawei was only slightly involved in the task by contributing its DriveOne digital power, Hi-Car panel plus audio systems.

In 2020, Huawei partnered with BAIC Motor Corp, a Beijing-based auto maker, and provided more components including the seat-control and driving support systems. It also helped Changan Automobile and lithium-battery supplier Modern Amperex Technology Company Ltd (CATL) produce a smart vehicle known as Avatr 11.

Last year, when Huawei partnered along with Seres again to produce SF7, it supplied most electronic parts in the car.

Chinese media remarked that Huawei definitely desired to focus on high-value parts and let auto manufacturers finish the low-end parts but which the latter would not have sufficient incentive.

Rong Hui, former vice president with New Technology Research Institute of BAIC Group, has said it turned out ill-advised for BAIC to rely as well heavily on Huawei’s smart car segments, which cost forty, 000 yuan (US$5, 800) each having a profit of fifteen, 000 yuan meant for Huawei while BAIC does not make a profit because of its part.

A columnist who specializes in the auto sector wrote that the returns associated with Huawei’s auto part business were less than expected. He said if Huawei attempted to share more earnings with automobile makers, it would take also longer to recoup its huge investments in the sector. This individual said Huawei should consider downsizing its clever car business.

US sanctions bite

In-may 2019, the US Business Department put Huawei and its 70 affiliate marketers on its Entity List on nationwide security grounds. This banned the sales of hardware and software involving US technology to Huawei and its subsidiaries.

Huawei then launched a huge promotion marketing campaign in June 2019 to criticize the united states and boost employees’ morale.

In a seminar called “A Coffee With Ren” in Huawei’s head office at that time, Ren informed visitors and foreign journalists that the US sanctions were indeed powerful but American customers’ trust in Huawei has been even more powerful.

He stated the US sanctions would not have a big impact on Huawei’s businesses, rates that were still being used by Chinese media until early this year.

Huawei then launched its HarmonyOS, or Hongmeng in Chinese, and used inventory chips plus self-developed Kirin chipsets to keep its smartphone output. It also boosted the output of Honor, its smartphone brand during that time.

However , this had to dispose of its entire stake within Honor in Nov 2020 so that the device could obtain ALL OF US chips. In the 4th quarter of 2020, Huawei slowed its smartphone production.

In 2019, Huawei, together with Honor, had been the No 1 smartphone maker within China with a business of 26. 5%, according to the industry study group Canalys.

Last year, Huawei’s market share fell to just 9. 3% while Honor a new 10. 4% market share, according to research group Cinno. Oppo positioned No 1 using a 20. 5% business while Vivo rated No 2 along with 18. 2%. Apple company and Xiaomi got 16% and 15. 2% of the marketplace, respectively.

Rich Yu, chief executive of Huawei Technologies Consumer Business Group, admitted during an open public event In late Might this year that Huawei’s businesses had been significantly hit by the US sanctions. Yu said Huawei had been “too naive” in assuming in globalization and never moving to make its very own chips many years ago.

On Aug 12 this year, Huawei reported the 5. 8% decrease in overall sales to 301. 6 billion yuan ($43. 9 billion) for your first half of this year from a year back.

Revenue of the company’s carrier company grew 4% to 142. 7 billion dollars yuan while that of enterprise business, which includes cloud and business services, increased 28% to 54. seven billion yuan. Income from devices, which includes sales of smartphones, dropped by twenty five. 3% to 101. 3 billion yuan.

Study: Huawei hopes for cellular revival with HarmonyOS 3

Follow Shaun Pao on Twitter at @jeffpao3