SINGAPORE: Hardly a day goes by without news of someone being scammed, or a new type of scam popping up. The sheer volume of scam-related news can be overwhelming. We might think, “I’ve heard it all before” or “It won’t happen to me”.

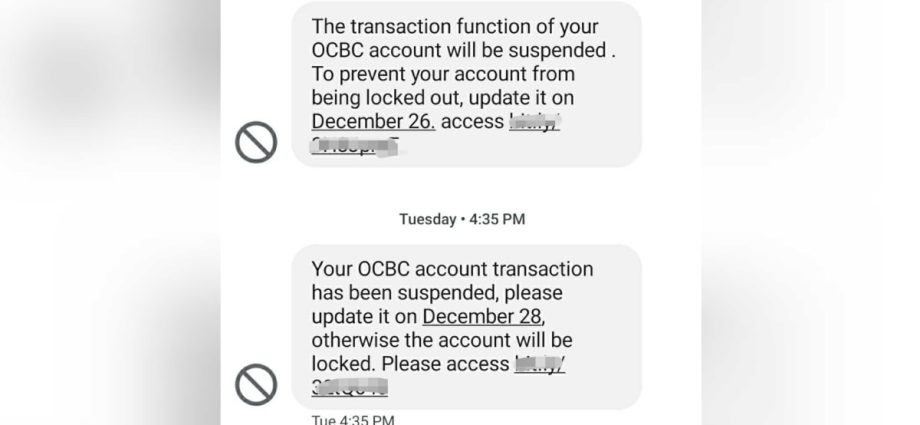

But scams have evolved from the days of poorly written emails offering questionable get-rich opportunities, to highly convincing schemes mirroring the practices of legitimate businesses.

The profits reaped from these deceptive practices have soared into the trillions. Globally, scammers stole about US$1.02 trillion in the past year, according to an October report by non-profit organisation Global Anti-Scam Alliance (GASA) and data service provider ScamAdviser. Singapore holds the unfortunate distinction of having the highest average scam amount per victim, according to the report.

In the first half of this year alone, 22,339 scam cases were reported in Singapore, a 64.5 per cent spike from the first half of last year, with fraudsters siphoning S$334.5 million from victims.

As the frequency of scams continues to rise, an important question arises: Are we, as a society, becoming desensitised to scams? Have we become so accustomed to the unending stream of phishing emails and robocalls that we are in danger of becoming indifferent or less vigilant in recognising and responding to potential threats?

It is important that we do not lose sight of the great hardship caused to the individual victims. For many, the losses could be their life savings or money needed to pay for basic necessities such as food, milk powder, rent or mortgage. The sudden loss of cashflow could be catastrophic for the victims and their families.