Global investors, who have been spooked by unpredictable crackdowns on sectors from e-commerce to education in recent years, have been streaming out of Chinese assets lately.

Foreign net selling of 82.9 billion yuan (US$11.4 billion) in Chinese stocks this month is a record outflow. Corporate investment is also going missing, with foreign direct investment (FDI) at its lowest since records began 25 years ago.

Raimondo is in Shanghai on Wednesday for the last day of meetings before returning to the United States.

Asked what her message was to US business in China, Raimondo said: “The message is to continue to do what you’re doing. We want you here investing, growing.”

But on Tuesday, she told reporters on a highspeed train from Beijing to Shanghai that US companies had complained to her that China has become “uninvestible,” pointing to fines, raids and other actions that have made it risky to do business in the world’s second-largest economy.

She is pressing China to take actions to improve business conditions.

China’s foreign ministry spokesperson did not respond directly to the “uninvestible” comment when asked at a briefing, instead repeating calls for the US to take more “practical and beneficial actions” to maintain ties.

Citing Premier Li Qiang, the spokesperson identified mutual respect, peaceful coexistence, and win-win cooperation as the correct ways for both sides to get along.

EU CHAMBER OF COMMERCE RESPONDS

“‘Uninvestible’ is not a term we would use to describe China,” Jens Eskelund, president of the European Union Chamber of Commerce in China, said in an emailed response to questions from Reuters on Raimondo’s remarks.

He added, however, that China was “under-invested” in terms of the amount of foreign direct investment it had been able to attract from Europe given the size of its economy, and noted that EU investment into China had been decreasing in recent years.

He also raised similar concerns to Raimondo about China’s business environment, including ambiguous regulations and security issues.

“China can do much to turn this around,” Eskelund said. “But it would take clear, concrete and specific action in terms of removing some of the concerns presently weighing on companies when making investment decisions.”

He cited a recent business survey from June which found almost two-thirds of its members indicated that they would consider expanding their presence in China should market access improve.

Michael Hart, president of the American Chamber of Commerce in China, said businesses had been “very clear” in making their concerns known to the Chinese government.

“Certain actions, including raids on companies and restricting data flows, are not conducive to attracting additional FDI,” Hart said.

“QUITE COMPLICATED”

Raimondo said American firms are facing new challenges, among them “exorbitant fines without any explanation, revisions to the counterespionage law, which are unclear and sending shockwaves through the US community; raids on businesses – a whole new level of challenge and we need that to be addressed.”

She said there was “no rationale given” for Chinese actions against chipmaker Micron Technology, whose products were restricted by Beijing this year, and rejected any comparisons to US export controls.

Raimondo said this week she did not pull any punches in meeting with Chinese officials to discuss the concerns of US businesses, including raising the treatment of Micron.

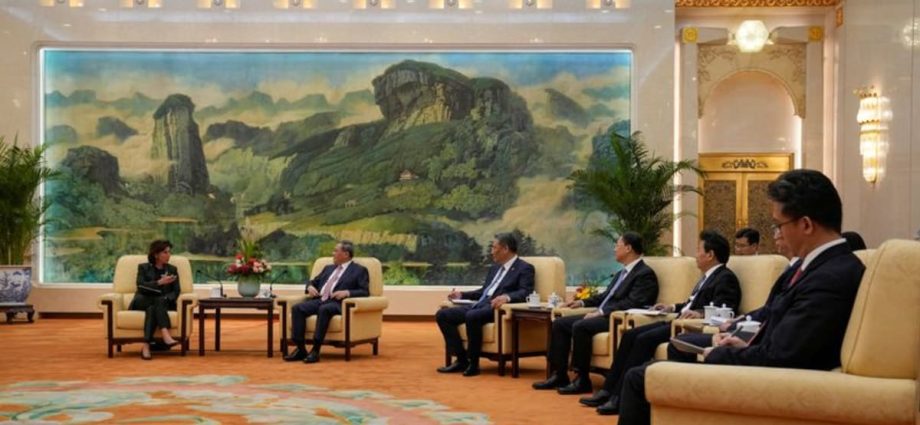

Raimondo, in opening remarks at a meeting on Wednesday with Shanghai Party Secretary Chen Jining, struck a positive tone saying she wanted to discuss “concrete ways that we can work together to accomplish business goals and to bring about a more predictable business environment, a predictable regulatory environment and a level playing field for American businesses.”