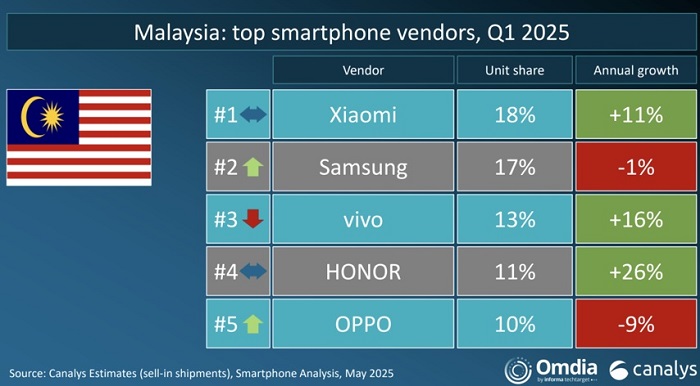

Xiaomi retains top spot as Malaysia’s most popular smartphone in Q1 2025

- Market share of 18 %, an 11 % rise over 2024, Samsung in 2nd position with 17 % promote

- Dual-brand approach with Xiaomi and Redmi continues to drive business speed

Canalys, a international market research firm, announced that Xiaomi has repeatedly secured the leading position among device suppliers in Malaysia for the first fourth of 2025, achieving a 18%-unit communicate in sell-in shipping, an 11 % growth over the past 12 months.

Eddie Huang, state director for Xiaomi Malaysia, said, “We’re very thankful to our Indonesian customers for their continued trust and loyalty. This success reflects not only our strength in technology and product creation, but also the important relationship we’ve built with our local group. ”

Xiaomi’s effective dual-brand approach continues to drive its speed in the market, centered on its two important device lines – Xiaomi and Redmi. The newly launched Xiaomi 15 set delivers premier performance and next-generation technology for premium users, while the Redmi Note 14 series remains a go-to choice for consumers seeking trusted, high-performance devices at available prices.

“ In 2025, we have made a significant foray into the ultra-premium market, both for our smartphones and AIoT lineups, ” Huang added. “We are continuously pushing the boundaries of what technology can deliver in terms of performance, design, and user experience. These flagship innovations represent our commitment to elevating everyday living through smart, premium solutions that are still accessible. ”

While it started out as a smartphone maker in 2010, the company today stands as a consumer electronics and smart manufacturing player with a “ Human × Car × Home” strategy encompassing a smart ecosystem that merges personal devices, smart home products, and cars.

.jpg)

.jpg)