Japanese auto giants know they need China to survive – Asia Times

Asian automakers are attempting to resurrect in China with their regional joint venture partners and Chinese manufacturers of self-driving and wise cockpit technology.

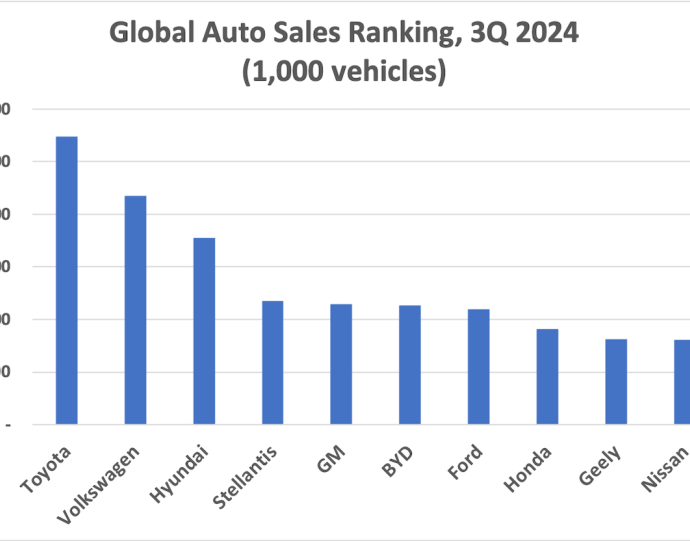

This may be their last chance, with their combined market share in China declining from 24.1 % in 2020 to 13.7 % in 2024, according to the China Passenger Cars Association.

At the Vehicle Shanghai 2025 trade show, General Manager Li Hui of Toyota China stated,” We need Chinese brains and hands involved in creation to deliver vehicles people want in China.” Li was appointed as Toyota China’s second Taiwanese general manager earlier this year.

The Japanese could never afford to be driven out of the world’s largest and most powerful engine business, even if US President Donald Trump’s taxes were no causing them to lose business there.

The Taiwanese Association of Automobile Manufacturers estimates that in China in 2024, almost 13 million new vehicles ( including battery-powered, cross, and fuel cell vehicles ) were sold. In contrast, US sales totaled almost 16 million fresh cars, of which about 3.2 million were NEVs.

The 21st incarnation of the exhibition, Car Shanghai 2025, took place from April 23 through May 2. Almost 1, 000 car, auto parts, and another auto supply chain firms from 26 nations and regions were reportedly present at the event, which was co-hosted by the Council for the Promotion of International Trade, Shanghai, and the China Association of Automobile Manufacturers,  .

One million people visited the museum, where 1, 366 cars were on screen, of which 70 % were NEVs. Car and Driver publication noted that” the car show is thriving in China, while car shows have carefully been withering away in the United States, with fewer in-person reveals each year.

Americans used to watch GM’s Motorama shows in the 1950s, gazing in astonishment at thoroughly practical concept vehicles like the turbine-powered, titanium-bodied Firebird III and displays that showcased autonomous driving systems. Strong forth seven years and China will see the arrival of the future in real time.

Asian automakers presented a number of new cars in Shanghai in an effort to contribute to that future.

Toyota introduced the bZ7 electric sedan, which was created by Guangzhou Automobile Group ( GAC ), Guangzhou Toyota Motor, and Toyota China Co’s Intelligent ElectroMobility R&, D Center. The bZ7 is notable for having Huawei’s HarmonyOS aircraft system.

Toyota’s Li discussed the company’s” One R&, D System, and Region Chief Engineer approach” to product development in China at the event, claiming that it “integrates resources from the Intelligent ElectroMobility R&, D Center by Toyota ( China ), FAW Toyota, GAC Toyota, and its joint venture with BYD into a unified platform, enhancing collaboration with local Chinese suppliers and technology firms.”

Toyota even unveiled its most recent Lexus ES luxury sedan, which is available in cross and, for the first time, genuine battery-powered versions.

The second set of” Ye Series” electric vehicles designed specifically for China were presented by Honda GT  and Dongfeng Honda GT. DeepSeek’s AI technology will enhance the vehicle practice in these and other Thou Series cars.

Nissan also presented the Frontier Pro, a plug-in cross pick created and manufactured by affiliated Zhengzhou Nissan, and the N7, a Dongfeng Nissan-made energy sedan. The N7 has Momenta’s Advanced Driver Assistance System ( ADAS ).

Toyota and Honda collaborate with Chinese company Momenta, which develops assisted driving systems that are used by GM, Mercedes-Benz, and Volkswagen. Momenta collaborates with BYD, GAC, and SAIC among Foreign manufacturers. SAIC, Toyota, and Daimler ( Mercedes-Benz ) are among Momenta‘s shareholders.

At the show, Momenta co-founder and CEO Cao Xudong stated,” We are the first Chinese firm to successfully deployed assisted driving systems, such as highway and city transportation capabilities, across multiple locations worldwide, including Germany, France, and Japan. In Toyota City and Stuttgart, Momenta has offices.

Sony, a first-time visitor to the event, was shown the new EZ-60 electric SUV created by Changan Mazda in partnership with Chongqing Changan Automobile Co. Sony, a joint venture with Changan Mazda, was at the event, and it was aimed at the Chinese in-car entertainment segment.

German producers approach Japanese makers similarly. Volkswagen made an announcement on the evening of April 22, the day before the show’s opening, that it calls” the next generation of intelligent, fully connected vehicles ( ICV )”.

The Volkswagen Group’s largest ICV-offensive in China to date will begin with Auto Shanghai 2025, according to the company’s website. As part of a comprehensive product offensive, the Group will release more than 20 fully electric and electrified models ( NEV ) by 2027. The Group’s brands will have around 30 all-electric models available by 2030.

Bosch, a German manufacturer of automotive parts, software, and services, signed a technology cooperation agreement with Chinese automaker Horizon Robotics. Bosch also made an announcement regarding its first order for in-car-cockpit AI computers for vehicles in China.

Bosch Cross-Domain Computing Solutions president Christopher Hartung stated to the Chinese press that” We look forward to working with top-notch partners like Horizon Robotics to jointly advance the global development of intelligent driving technologies.

German automakers ‘ share of the Chinese market is currently about 13 %, according to MarkLines, like their Japanese rivals. They are also looking for ways to regain their share of the market after losing to local automakers, just like the Japanese. According to ZF‘s CEO,” If you stop investing here, you get left behind.”

A sizable portion of China’s auto market should still be owned by the Japanese and Germans. The shares of Hyundai Motor, its affiliate Kia, and the premium brand Galaxy, which are all down below 2 %, cannot be said about them.

The Americans, led by General Motors ( GM ), own about 9 % of China’s market, including through their regional joint ventures. Only 2 % of total auto sales in China are made by Tesla, and only 5 % of NEV sales are made by that company.

Follow this writer on , X: @ScottFo83517667