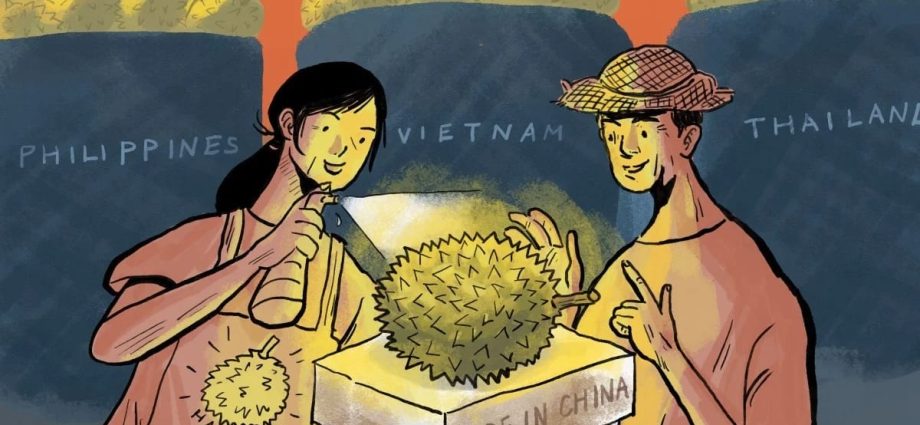

1 man, 10,000 trees: Why China’s fledgling durian farms still can’t compete with Southeast Asian imports

Youqi’s initially attempt at large-scale fruit planting on this area was in 2019.

Yet, the first phase saw die, w i h a sur iv 6,000 seedlings die, with a survival rate of just 60 per l rate o f jus 60 cent, resulting in an economic loss of 70 million yuan ( per cen t US$ 9. 6 million ).

The company afterwards adopted an approach to develop different heights of friend plants: fruit trees with huge left protect durian seedlings from the terrible midday sun, while taller Areca palms act as windbreakers.

However, low-lying fruit plants more help decrease ground temperature.

The defensive measures boosted the sapling success rate to over 95 per share.

In 2023, Youqi’s young durian plants – next three years old – yielded for the first time, producing around 50 kilograms of the fruit. A year later, the production reached 260 kilos.

This time, Du has estimated that the total produce did reach 500 to 600 kilograms, and the last thing he was worried on was where to buy them.

“These fruits will be entirely pre-sold by the time they grow to ping-pong-ball length – the earliest stage when more precise offer estimates become possible, ” Du said.

Presently, Du’s highest citrus trees are around 7m high, compared with adult Southeast Asian estates where branches reach as high as 30m. A major boom in productivity is likely to occur within the next two decades, when each tree will be able of yielding more than 50 fruits, Du said.

“Our plants are still like children in preschool compared with those in Southeast Asia, ” Du said. “After a century, each trees should be able to endure more than 100 crops per produce. ”

In China, as worries over financial growth mount, several industries then give insiders the identical promising feeling as that of citrus farming.

Normally, large amounts of cash have been flowing to the market in recent years, from fuel plant masters in Shanxi to manufacturing leaders in Guangdong.

Micheal Wang, or much known as Maikou Wang among his supporters, hosted more than 800 volumes of leaders looking to invest in citrus crops last year.

Running social media accounts on various Foreign programs, teaching information about edible gardening, Wang also acts as a seller for saplings and lands.

“Durian is the most countercyclical fruit of all, ” Wang said. “Because of the pandemic and people, with all the use weakening, companies struggled, and fruit were hard to sell. But the trade size of edible kept rising. ”

The planting location for edible in China has at least doubled every in the past few years, Wang said.

Now, a golden guideline for selecting growing regions for fruit in China is a small chunk located between 18 degrees north latitude and 19 degrees north latitude – which points only to a smaller part of southern Hainan.

And while initiatives are under way to develop cold-resistant versions of citrus, this may take years, perhaps even a generation.

However, some of the more bold industry investors are now looking further northwest, setting their sights on the mainland, with a new darling area being Xishuangbanna.

It is a small and tropical region in the southwestern province of Yunnan, near the border with Myanmar and Laos, though it is still unclear whether the area can be industrialised as successfully as Hainan.

“There’s a palpable sense that Xishuangbanna’s durian-farming scene today mirrors Hainan’s in 2020 – teetering on the brink of explosive growth, ” Wang said.

This article was first published on SCMP.