After the American company allegedly cut energy supplies by half because of an underpaid$ 800m costs, Bangladesh is ramping up obligations to Adani Power.

Adani, which supplies 10 % of Bangladesh’s power, is currently being processed by two senior government officials, according to two state sources.

A senior Bangladesh Power Development Board official told the BBC,” We have addressed payment issues and already issued a$ 170 million ]£143m ] letter of credit to Adani group.”

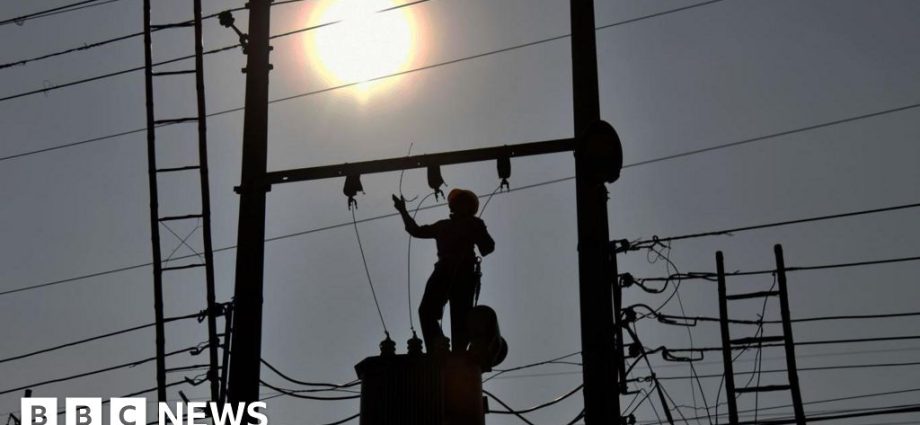

Adani products Bangladesh from its 1600 watt coal-fired plant in southeast India. The company has n’t responded to BBC queries about cuts to its supply to Bangladesh, which suffers regular power shortages.

According to reports, the firm has threatened to halt all purchases if the money owed to it is not paid for by November 7th. However, the Bangladesh Power Development Board official claimed that they “did not think it would not occur” that supplies may be completely cut off.

Officials from Bangladesh told the BBC they are comfortable in resolving the payment crisis and that they may make payments slowly and regularly.

” We are shocked and surprised that resources have been cut despite us ramping up bills.” We are prepared to pay back and take alternative arrangements, but we wo n’t let any power producer hostage us or blackmail us, according to Fouzul Kabir Khan, energy adviser to the interim government.

Bangladesh stepped up repayments from$ 35m in July, to$ 68m in September and$ 97m in October, he said.

In remote areas, there are already more severe power shortages in the nation.

Bangladesh has been having trouble generating foreign currency to pay for expensive, necessary goods like light, coal, and fuel. Following decades of student-led demonstrations and social unrest that led to the Sheikh Hasina government’s ouster in August, foreign currency reserves decreased.

In addition to its current$ 4.7 billion bailout package, the interim government that took her place has requested an additional$ 3 billion loan from the International Monetary Fund ( IMF).

Adani’s energy deal with Bangladesh, signed in 2015, was one of the many under Sheikh Hasina, which the present time government has called thick. A federal committee is then reassessing 11 previous offers, including the one with Adani, which has often been criticised as expensive.

Another American state-owned companies, such as NTPC Ltd and PTC India Ltd., are selling power to Bangladesh, according to officials from the Power Development Board, who confirmed that partial payment of money owed to various American energy suppliers are also being made.

To address the source shortage, Bangladesh is restarting some of the gas- and oil-fired energy plants, despite the claims that it will raise electricity prices. As air conditioners are down, power usage on the grid is anticipated to decrease as the winter draws near.

It is crucial to maintain the readymade power supply from Adani because other coal-fired plants are operating at 50 % power and the nation is unable to purchase enough coal due to the dollar crisis. Although it is marginally more expensive than local producers, the supply is important, according to retired professor and energy expert Dr. Ajaj Hossain.

In order to expand its energy mix, Bangladesh plans to start building its first nuclear power plant in December. Built with Russian help, it is costing$ 12.65bn, typically financed by long-term Russian money.