Salesforce to invest US$1 billion in Singapore over five years

- Funding supports Singapore’s National AI Strategy 2.0

- The investment may allow Singapore enterprises to build enormous electronic workforces

.jpg)

Salesforce has announced plans to invest US$ 1 billion ( RM4.4 billion ) in Singapore over the next five years, reaffirming its commitment to accelerating the nation’s digital transformation and Agentforce adoption. In a speech, the business highlighted Singapore as an important growth sector as companies increasingly embrace Agentforce to activate new opportunities. This funding underscores Salesforce’s aid for Singapore’s National AI Strategy 2.0 and the world’s vision as a world AI development hub.

Spurred by a US$ 6 trillion ( RM27 trillion ) digital labour market, thousands of customers worldwide are investing in Agentforce, Salesforce’s digital labour platform to build and deploy agents that can reason, decide, act, and drive meaningful outcomes 24/7. Singapore has been grappling with a slowing labour army development level, driven by an ageing population and declining birth rates. Agentforce offers Singapore a chance to quickly expand its workplace across vital support and public field roles.

This funding will enable Singaporean enterprises build enormous electric workforces, uniting humans with trusted intelligent Agentforce agents to activate new levels of efficiency, innovation, and growth. As Agentforce implementation accelerates, it has the ability to generate significant effects across Singapore’s industries, startups, and public market.

Jermaine Loy, managing director of the Singapore Economic Development Board, said:” Singapore welcomes Salesforce’s purchase, which will increase our continuing efforts to build a lively hub for AI development and implementation across our business. Salesforce’s initiatives in AI research and workforce development will strengthen our ecosystem by catalysing innovation for key industries and corporates based in Singapore”.

.jpg) ” We are in an incredible new era of digital labour where every business will be transformed by autonomous agents that augment human work, revolutionising productivity and enabling every company to scale without limits”, said Marc Benioff ( pic ), chair and CEO of Salesforce. He added that Singapore is at the forefront of this shift, and as the largest provider of digital labour through its Agentforce platform, Salesforce is thrilled to expand its work with the business community and its long-time partners in the region to drive innovation, productivity, and growth.

” We are in an incredible new era of digital labour where every business will be transformed by autonomous agents that augment human work, revolutionising productivity and enabling every company to scale without limits”, said Marc Benioff ( pic ), chair and CEO of Salesforce. He added that Singapore is at the forefront of this shift, and as the largest provider of digital labour through its Agentforce platform, Salesforce is thrilled to expand its work with the business community and its long-time partners in the region to drive innovation, productivity, and growth.

Salesforce has been investing in Singapore for nearly two decades, building a thriving customer base and partner ecosystem in the region. Its customers include industry leaders such as Singapore Airlines, Grab, M1, FairPrice Group, Ocean Network Express, and PRISM , who use Salesforce AI technologies to drive efficiency, enhance customer experiences, and unlock new revenue streams.

Singapore plays a crucial role in driving Agentforce innovation for Salesforce. In 2019, the company expanded its AI Research team internationally, choosing Singapore as its first overseas AI Research hub. Since then, the hub has significantly contributed to the global development of AI for the industry. This includes the development of industry-leading models such as multimodal language-vision foundation models and time-series foundation models ( Moirai ). The AI Research hub has also contributed to product innovations such as AIOps Agents, which help Salesforce achieve the highest levels of site availability, and in-house code LLMs that assist customers in optimising their code for performance. Their work has resulted in the publication of over 100 research papers and patents.

This continued investment will not only drive Agentforce innovation through the research hub but also support Salesforce’s expanding customer base in the region.

Notably, Singapore Airlines and Salesforce recently announced that the airline is integrating Agentforce, Einstein in Service Cloud, and Data Cloud into its customer case management system to deliver more consistent and personalised service. Additionally, the two companies plan to co-develop AI solutions for airlines at the Salesforce AI Research hub in Singapore, aiming to deliver greater value and new benefits to the industry.

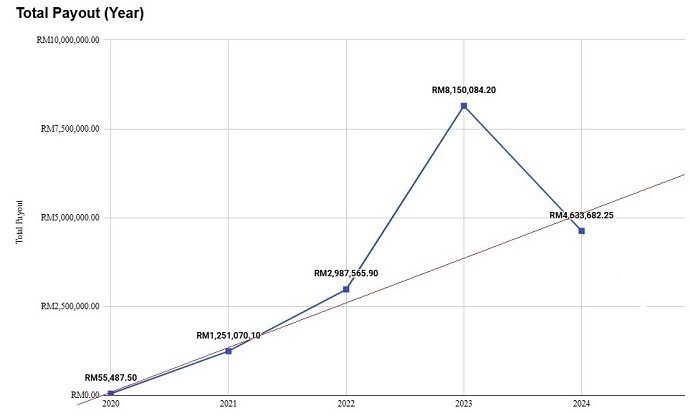

,” This problem wasn’t fresh, I only suffered through it”, said Tiffany Khoo, a leading scholar who left a legitimate career at Bank Negara Malaysia in late 2019 to become Human manager at iHEAL Health Sdn Bhd, a little medical centre in Kuala Lumpur, run by her father.

,” This problem wasn’t fresh, I only suffered through it”, said Tiffany Khoo, a leading scholar who left a legitimate career at Bank Negara Malaysia in late 2019 to become Human manager at iHEAL Health Sdn Bhd, a little medical centre in Kuala Lumpur, run by her father.

.jpg)