MRANTI launches KL Innovation Belt to spur Malaysia’s startup ecosystem

- Over the next three decades, plan to build KLIB centres in Bukit Jalil and Bangsar.

- Industries such as electricity &, greentech, manufacturing &, technology, agriculture

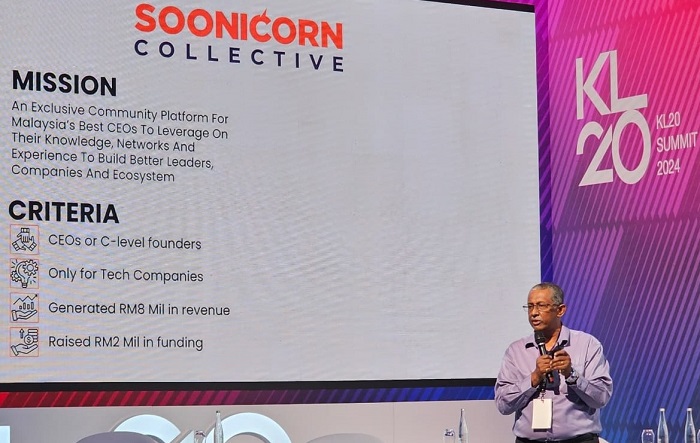

With the launch of the KL Innovation Belt (KLIB ), a one-stop center for startups and investors, Technology Innovation Park Malaysia ( TiPM/MRANTI ) is issuing a clarion call to all innovators. The ground-breaking system of centres across the Klang Valley is intended to serve as their successpad, which was announced at the KL20 Summit in April.

[MRANTI’s fresh name, TiPM, was approved by the board. [Update: The name change will be made soon. ]

The Ministry of Economy has taken the initiative known as KL20 to make Kuala Lumpur the top-20 international business hub by 2030. By creating a centralized, attractive ecosystem that brings up businesses, investors, and academic institutions, this plan aims to spur innovation and economic development.

However, the release of the KL20 Action Paper outlines over 20 revolutionary reforms to lead strong growth and investment in Malaysia’s it sector.

KLIB touted to enable businesses and buyers

According to TiPM the KLIB helps companies and investors by fostering engagement, technology, and growth, enabling them to grow to greater heights.

Chang Lih Kang, Minister of Science, Technology and Innovation ( MOSTI), said,” We welcome you, as a Pioneering Innovator, to be part of a community targeted to grow within the next three years into a network of 500 companies, investors and industry leaders, with potential to collaborate with like- minded people whilst having access to support services tailored to your business”.

These hubs may concentrate on nurturing vital sectors including energy &, greentech, manufacturing &, automation, agriculture and Muslim economic services, aiming to foster a self- sustaining startup ecosystem that promotes constant innovation and growth.

Each hub will have easy access to government agencies and dedicated co-working spaces for networking events.

Dr Rais Hussin, CEO of TiPM said, “KLIB Innovators also stand to benefit from scalable office space that can accommodate up to 100 companies at any one time, high- speed internet, convenient access to transportation, as well as, important facilities such as F&, B and leisure”.

In addition, innovators will have access to investor pitch sessions and direct access to a pool of potential investors. TiPM will offer special rental and utility packages for the first three years in addition to the initiative, which will also include significant incentives for early movers.

Interested parties are encouraged to register their interest at http ://www.mranti.my/klib

The company’s current residents include numerous multi-billion-dollar corporations as well as numerous promising startups that have achieved significant success. The startup residents have already established hundreds of jobs and successfully raised nearly US$ 400 million ( RM1.9 billion ) in funding.  ,

The company’s current residents include numerous multi-billion-dollar corporations as well as numerous promising startups that have achieved significant success. The startup residents have already established hundreds of jobs and successfully raised nearly US$ 400 million ( RM1.9 billion ) in funding.  ,

.png) AEON Bank, Malaysia’s second Muslim modern banks, has announced a strategic partnership with Visa. This new partnership marks a major step in their efforts to transform the experience for local Malaysians using electronic payments and cashless transactions.

AEON Bank, Malaysia’s second Muslim modern banks, has announced a strategic partnership with Visa. This new partnership marks a major step in their efforts to transform the experience for local Malaysians using electronic payments and cashless transactions.