GE2025: What the main political parties have to say about immigration in their manifestos

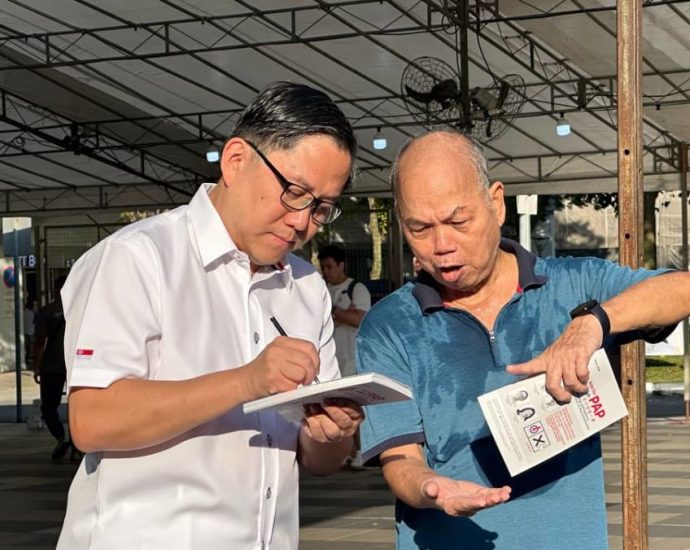

Immigration continues to be a hot-button problem for some Singaporeans, as it has become over the years. Therefore, it should come as no surprise that the political events organizing the May 3 General Election are offering a variety of coverage options. CNA examines the key ideas made by the fiveContinue Reading