Sri Lanka’s fiscal situation has been facing turmoil since the global financial crisis of 2008 as well as the 26-year-long civil war that ended in 2009, draining the country of valuable resources over the years. The present economic breakdown is a result of various political missteps, which cascaded into the collapse of the political administration as well.

The political mismanagement ranged from the sweeping tax reforms in 2019 to the abrupt imposition of organic farming in 2021. The problems were compounded by the financial stress from managing the Covid-19 pandemic, the mounting foreign debt, and the skewed soft-power dynamics with China.

Managing the pandemic entailed added costs to the health-care system. Along with this, the spending by the government on social-security programs targeted at poverty eradication and unemployment saw a significant increase.

While government departments were facing a challenging time managing their budgets due to the fiscal crisis, this was precisely when the presidential challenger for the 2019 general election, Gotabaya Rajapaksa of the Sri Lanka Podujana Party, released his manifesto that promised sweeping tax cuts if elected to power.

The manifesto, titled “Ten Principles of Inclusive Government,” proclaimed that “the prevailing tax system has contributed to the collapse of the domestic economy by discouraging domestic entrepreneurs. We would, instead, introduce a tax system that would help promote production in the country.”

However, evidently the fallout of the changes in these taxation policies has been detrimental for the Sri Lankan economy.

| Tax Category | Amendment |

| Value Added Tax (VAT) | Reduced from 15% to 8%. |

| Nation Building Tax (NBT) | The earlier 2% NBT was abolished. The NBT was combined with the Ports and Airport Development Levy with a relevant ratio of 10%. |

| Economic Service Charge | Eliminated |

| Debit Tax on Banking and Financial Institutions | Eliminated |

| Capital Gains Tax on the Share Market | Eliminated |

| VAT on Sovereign Property | Eliminated |

| Pay As You Earn (PAYE) Tax | Eliminated |

| Withholding Tax on Interest Income, other types | Eliminated |

| Credit Service Tax | Eliminated |

| Tax on Telecommunication Tariffs | Reduced by 25%. |

Going by macroeconomic theory, the goal behind these tax reductions was to induce economic growth in the medium and long terms by promoting the utilization of disposable income and money supply in the economy.

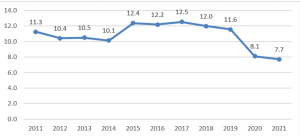

However, in the short term, the pandemic wreaked havoc on the country’s revenue and the tax reliefs added more burden to the national treasury, resulting in tax revenue as a percentage of GDP being reduced from 8.1% in 2020 to 7.7% in 2021.

Because of these changes in taxes, the number of taxpayers dropped by a million between 2020 and 2022. The reduction in taxes could not be handled by an economy where the contribution of direct taxes to the GDP was already only 2%.

Sri Lanka also features among the countries with the lowest tax-to-GDP ratios in the South Asian subcontinent. Along with the measly tax-collection rates, various tax-evasion methods have also been historically high. For instance, evasion by underreporting the value of imports and mislabeling imports have been rampant.

Government revenues decreased and spending increased, resulting in the widening of the budget deficit. The government relied on external debts to manage this, which caused its debt-to-GDP ratio to balloon from 86.9% in 2019 to 105.6% in 2021.

One must not forget that Sri Lanka is no stranger to large fiscal deficits. The average fiscal deficit over the 2011-20 period was 6.2% of GDP. The usual procedure was the government seeking domestic and foreign finances for managing the deficit. This time, however, foreign sources could not be accessed as its credit rating was downgraded in April 2020.

This shows the structural weakness in the Sri Lankan economy as the country has been reliant on external loans to tide over its deficits. This reliance resulted in the Sri Lankan economy suffering the effects of exogenous shocks in the form of the Covid-19 pandemic and the Ukraine-Russia conflict.

To escape from the current economic crisis, the Sri Lankan government announced a reversal of the taxation reductions. The VAT was initially increased to 12% in May 2022 and the recently passed interim budget increased it to 15%. The budget also mandates other measures such as registration of all persons aged above 18 in the income-tax system.

The recent agreement with the International Monetary Fund involves more tax reforms to strengthen the fiscal position of the country. The Sri Lankan government must address such structural weaknesses of the domestic economy on a priority basis. Depending on loans to cover the revenue shortfalls without addressing such issues will lead to further deepening of the crisis.

The author acknowledges Aravind J Nampoothiry at the National Law School of India University in Bangalore for his research assistance on this article.