Getty Images

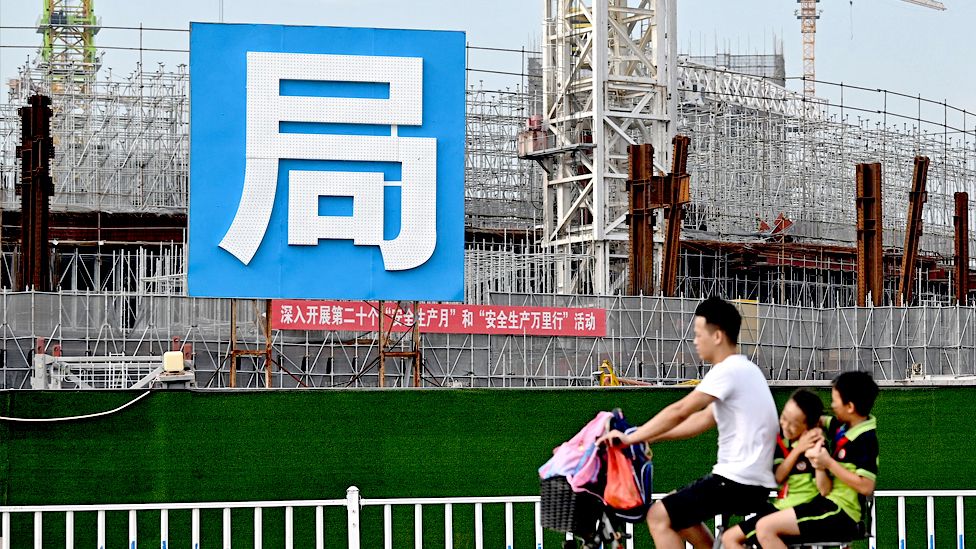

Getty Images Embattled Chinese property giant Evergrande is expected to deliver an initial restructuring plan this week, following the exit of two bosses.

The firm says its chief executive and finance head have got resigned, after an internal probe found which they misused around $2bn (£1. 7bn) in loans.

Evergrande has more than $300bn in liabilities and defaulted on its debts late last year.

The particular crisis has spooked traders who dread contagion in China’s property sector.

Upon Friday, Evergrande mentioned it found that will chief executive Xia Haijun and chief economic officer Pan Darong were involved in directing 13. 4bn yuan ($2bn; £1. 7bn) in loans guaranteed by its property services unit to the wider group.

The firm stated in a filing towards the Hong Kong Stock Exchange that Mister Xia and Mr Pan had resigned because of their “involvement within the arrangement of the pledges”.

In a separate statement, it said the particular funds “were moved and diverted to the group via 3rd parties and were used for the general functions of the group”.

Evergrande added that it was in talks with its home services unit more than a repayment plan.

The $2. 6bn deal to sell a majority risk in the unit to a rival developer fell through in October .

Evergrande, which is the particular world’s most indebted property developer, have been struggling to make payments on its over $300bn of liabilities and missed a crucial repayment deadline on its offshore debt in December.

Its shares have dropped by more than 75% over the last year in Hong Kong and have been suspended from investing for months.

The company is definitely scheduled to declare a preliminary plan to restructure its debts prior to next week.

China’s property crisis is estimated to have wiped greater than a trillion dollars from the value of the field last year.

The very severe potential fallout through Evergrande collapsing offers led some analysts to suggest that Beijing may step in.

On Monday, Japanese financial giant Nomura stated “an increasing number of developers have failed to repay their debt and continue their construction works” because the Evergrande crisis.

Furthermore on Monday, it had been reported that Cina was planning to start a real estate fund to support more than a dozen property developers, including Evergrande.

The fund might be worth up to 300bn yuan, according to reports.

House sales in China and taiwan have fallen to get 11 consecutive weeks, official data shows. That is the longest downturn since China created a private property marketplace in the late 1990s.

Several Chinese programmers have halted the construction of homes that will had already been offered, because of concerns over cash flow.

In current weeks, some house buyers have threatened to stop paying their mortgages until the work restarts.

More than two hundred projects by a minimum of 80 developers are actually affected, according to the Shanghai-based E-house China R and d Institution.

The China and taiwan Banking and Insurance plan Regulatory Commission has pledged to help local governments in “guaranteeing the delivery of families, ” state press reported.

You may also be interested in:

This video cannot be played

To play this video clip you need to enable JavaScript in your browser.

-

-

5 Come july 1st

-

-

-

20 December 2021

-

-

-

30 September 2021

-