Tuesday’s 5% plunge in the NASDAQ followed a higher-than-forecast August year-on-year rise of 8. 3% in the US Consumer Price Index. Shelter, which represents almost a third of the index, accounted for most of the surprise, rising 8. 6% year-on-year, according to the Bureau of Labor Statistics.

The only surprise is that investors didn’t see this one coming.

I’d warned a year previously that will “US rent hikes will explode customer inflation in 2022. ” After all, the current rent inflation comes up in tomorrow’s Consumer Price Index because leases expire. The particular August 2022 leap in rent pumpiing is just the beginning.

By increasing interest rates, the Fed is making inflation worse. Housing is within short supply, and higher interest rates make it harder to build new rental units. This is simply not a credit-driven pumpiing but a supply-side shortage.

Private-sector measures of lease inflation, including Zillow and Apartmentlist. com, show rents rising at a double-digit price for the past year, as the official measure of lease inflation remained within single digits.

As I wrote within August 2021, “It takes the Agency of Labor Statistics about a year to catch up with rent pumpiing. What the government documented as rent inflation in July displays the economy of the year ago and more. That’s because renters’ leases take a year or two to expire. The Zillow, Apartmentlist. com and CoreLogic reports reflect the average rent on a new rent, not the lease on leases agreed upon in the past. As outdated leases expire plus renters have to pay the greater market rate, lease inflation will rise. ”

The chart below procedures the relationship between past changes in the Zillow Rent Index and current changes in the CPI protection component. Past ideals of the Zillow catalog show a very high correlation with present values of the CPI rent index.

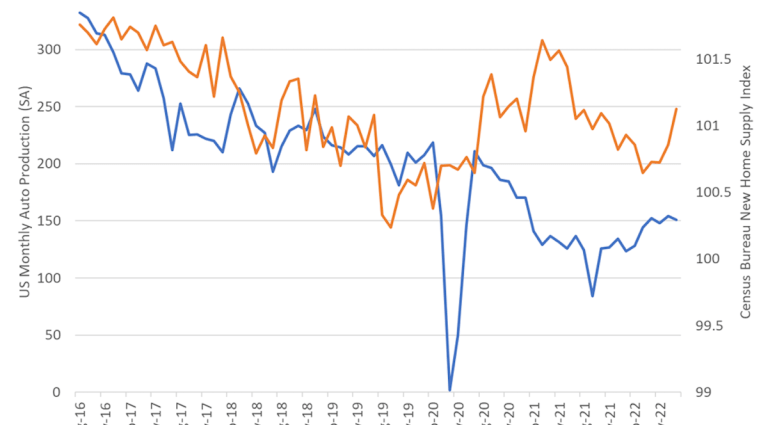

Behind the unprecedented jump in rents is a shortage associated with housing. Both cars and houses – two of the biggest sources of the present inflation wave – show declining production. An explosion of requirement due to transfer payments during the COVID outbreak ran into declining supply, and costs exploded.

Interest rates did not trigger the problem, and the Fed will only make matters worse by raising rates.