Snap Insight: ‘Make America wealthy again’? Latest Trump tariffs will only make trade with US more complex and uncertain

GROWING Difficulty OF Buying WITH US

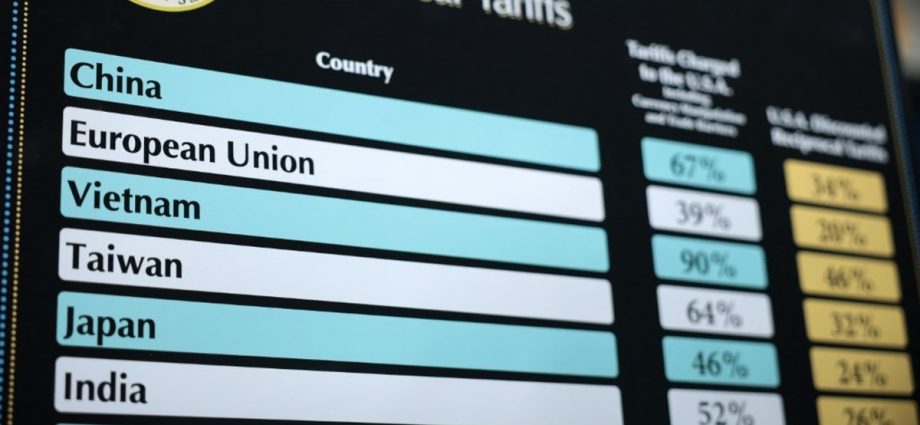

In many instances, these novel mutual tariffs are stacked on top of an array of existing taxes. China is particularly badly hit by this method, as businesses will need to contain any existing Part 301 taxes from the first Trump term ( usually up to 25 per cent ), another 20 per cent imposed earlier this year under Trump 2.0, before adding the latest 34 per cent mutual price.  ,

The US has begun collecting 25 per cent taxes on all products of metal and metal or made with these aluminum. For these categories of goods, mutual taxes do not use, which highlights the growing difficulty to managing deal with the US.

These are not the only levies on the horizon both.

From Apr 3, imported cars into the US had to knife over an extra 25 per share price. The same frequency may be levied against car parts immediately. Both are covered by a spacecraft alleging regional security issues. Mr Trump has already promised related treatment of metal, lumber, essential minerals, medicine and semiconductors.  ,

The Trump presidency promised shock and awe. It has truly delivered both, along with considerable confusion.  , Asia will need to quickly figure out how to best take advantage of quick changes in the economic environment and minimise the damage back.  ,

Deborah Elms is Head of Trade Policy at Hinrich Foundation and Founder of the Asian Trade Centre.