Commentary: Asian consumers could soon be paying with stablecoins

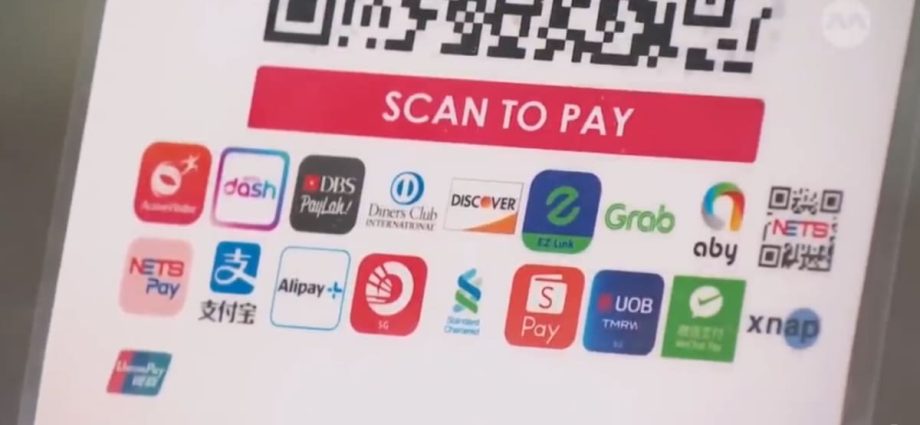

By working with Ant Group and Grab Holdings, StraitsX, the lender of XSGD, may end the , pay loop. The Singaporean merchants wo n’t need to maintain an a  relationship with Ant, and the Chinese tourists will no longer have to deal with &ndbp, Grab.

Cross-border deals will be processed instantly, saving small businesses from having to pay high credit card fees. At the same time, regulators will make sure that stablecoins do n’t end up becoming new channels for money laundering by specifying the payment purpose  and imposing prudential limits on transfers.

People will generally have three options in addition to standard payment methods, like as , bank accounts, or actual cash. Once they , central bank digital currencies ( CBDCs ), became available, they could use them to settle claims.

Alternately, their lenders might permit them to tokenize deposits and make advance payments, such as toward  or a rental contract, but only after the other party has fulfilled its contractual obligation. As an alternative, payers and payees may use stablecoins to maintain their value even if their personal issuers filed for bankruptcy, so long as they trusted them.

Client PROTECTION AND Clarity

Because of this, the focus of the new stablecoin regulations in Asia ( and Europe ) is on consumer protection and transparency.  ,

Issuers may be required to disclose the value of their assets and liabilities each and every day, according to the papers that Hong Kong has circulated for public discussion. Every week, they are required to breakdown the makeup of their reserve assets and create an auditor’s report andnbsp, once a month.