BEIJING: The head of heavily indebted Chinese property developer Evergrande’s electric vehicle (EV) arm has been detained by authorities, the firm said on Monday (Jan 8).

Once China’s biggest real estate developer, Evergrande has reported more than US$300 billion in liabilities and its troubles have become a symbol of the nation’s years-long property crisis.

News of Liu Yongzhuo’s detention followed the firm’s announcement in September that chairman Xu Jiayin was “subject to mandatory measures” from Chinese authorities over “crimes”.

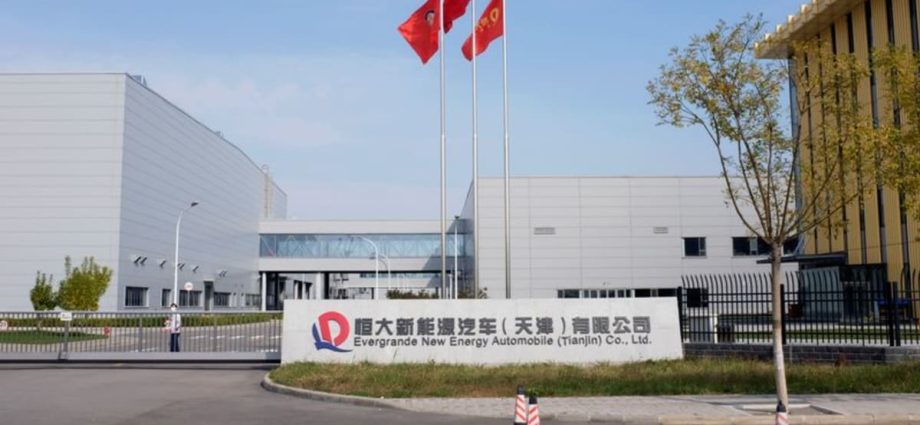

“The company has learned that its executive director Mr Liu Yongzhuo has been detained in accordance with the law on suspicion of illegal crimes,” the unit, Evergrande New Energy Vehicle Group (NEV), said in a filing to the Hong Kong stock exchange on Monday.

It did not give further details on why exactly Liu – who is listed on its website as president of the EV arm – had been held.

At the time of its establishment in 2019, Evergrande NEV said it aimed to become the leading manufacturer of electric cars in just “three to five years”.

But as its parent company grappled with an increasingly dire financial situation, the EV unit’s cash flow and growth outlook were heavily impacted.

Evergrande NEV indicated in March 2023 that it was fighting to secure liquidity in order to stay afloat.

On Monday, shares in the firm were halted briefly on the Hong Kong Stock Exchange “at the request of the company”, the statement said.

After restarting trading at 1pm, the EV firm’s share price fell 5 per cent.

The announcements come after the failure of a deal that would have sold a stake in Evergrande NEV to NWTN, a Dubai-based firm specialising in clean-energy vehicles.

Following a long delay, the firm began production of its first EV model – the Hengchi 5 – in 2022.

Evergrande NEV shares were suspended for 15 months between April 2022 and July 2023, owing to the firm’s failure to publish financial results.

It is currently valued at around US$570 million, having lost almost half its value in five years.

And as the real estate giant’s woes deepened, a Hong Kong court last month gave it until late January to put together a restructuring plan, extending a deadline that could lead to its liquidation.