Here is an extract from the discussion:  ,

Andrea Heng:

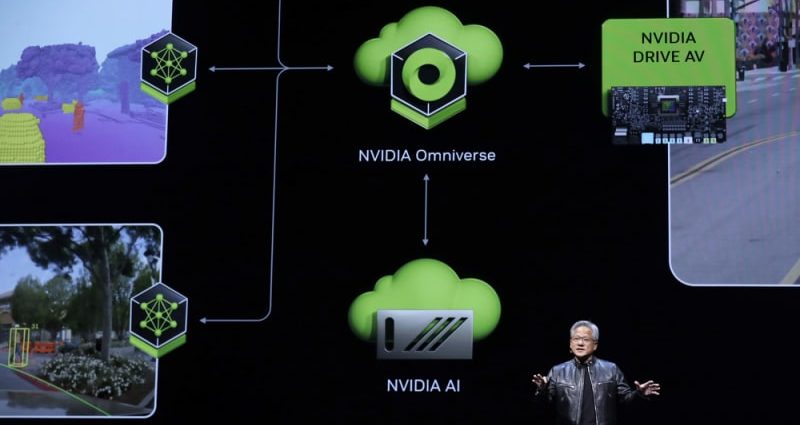

We have to speak about Nvidia. This is the AI sweetheart, the king jewel in technology today. And for long, all we ever heard was Nvidia this, Nvidia that, Nvidia the unique. So during the sell-off,$ 279 billion wiped out from its inventory and… it was a report one time wipeout of any US business, of any US property. Is this a signal that the AI bubbles that people keeps speculating on is finally here?

Garett Lim:

I do n’t think so. Nvidia is undoubtedly a great and simple way to look at what’s happening in AI, but it’s not the only person in AI to use that term. And what’s actually been happening is that Nvidia’s current population is extremely obese. Not only institutions, but I may say retail since well. And… I believe Nvidia’s utilize wagers were also very high. Therefore, it’s likely that those who have borrowed yet more money to invest in Nvidia will need to leave ( as soon as possible ) when they experience such a shock. There were perhaps a lot of margin calling at the time, therefore.

But I also keep wanting to genuinely inform my listeners that you must put things into perspective. This time, as well as the previous month, Nvidia has had an incredible work. So to really just say,” Hey, is this the end of ( an ) AI rally because we’ve seen a 10 per cent or 15 per cent or 20 per cent fall in the stock price as of last week”, I think you probably would have to say,” Look, we’ve had a phenomenal run”.