Thai-Laos QR payments to boost tourism

National banks vision increase in spending

PUBLISHED: 8 Apr 2024 at 06: 00

After the Bank of Thailand ( BoT ) and the Bank of Lao ( BoL ) announced a new QR payment system to support electronic transactions on Sunday, spending money on both sides of the Thai-Laos border appears to be rising.

On Sunday, Khon Kaen Chamber of Commerce president Khemchat Somjaiwong welcomed the announcement that the BoT and BoL had reached an agreement on the eve of the 11th Asean Finance Ministers ‘ and Central Bank Governors ‘ Meeting in Luang Prabang on April 3.

The cooperation is intended to boost the next quarter’s overall financial health, particularly with the upcoming Songkran and Lao New Year celebrations set to take place in the middle of this fortnight.

” First, Chinese people who travel to Thailand is check the Thai PromptPay QR code on their wireless phones to make purchases in Thailand.” He claimed that the company has been in place since April 3.

Thai citizens may apply their mobile banking apps to purchase goods and services in Laos starting at the end of June in the second phase. The services will increase spending, particularly in Laos ‘ Vientiane and Nong Khai territory in Thailand.

As some Thai people cross Thai-Laos connection bridges to purchase goods, see physicians, attend seminars, or take a relaxing vacation, other provinces like Udon Thani and Khon Kaen did also gain. They wo n’t have to worry about payment, as paying by QR code will be convenient”, he said.

According to BoT, the assistance will boost business, investment, tourism and the use of native assets under the Asean Payment Connectivity program.

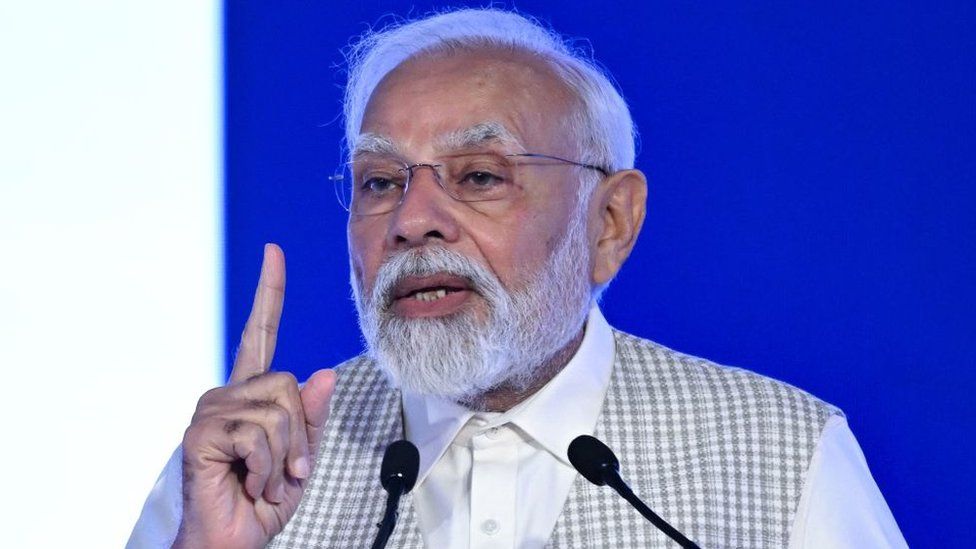

Sethaput Suthiwartnarueput, the central bank government, said before the BoT recognised the importance of cross- border genuine- time payment linkage and has collaborated with five Asean countries including Cambodia, Indonesia, Malaysia, Singapore and Vietnam.

” Our sixth link is under the Asean Payment Connectivity effort,” says Lao. We think cross-border QR payment services will be a more secure, cost-effective, and safer alternative to traditional retail payments in Asean, helping to spur regional economic growth and aiding the transition to a modern society.

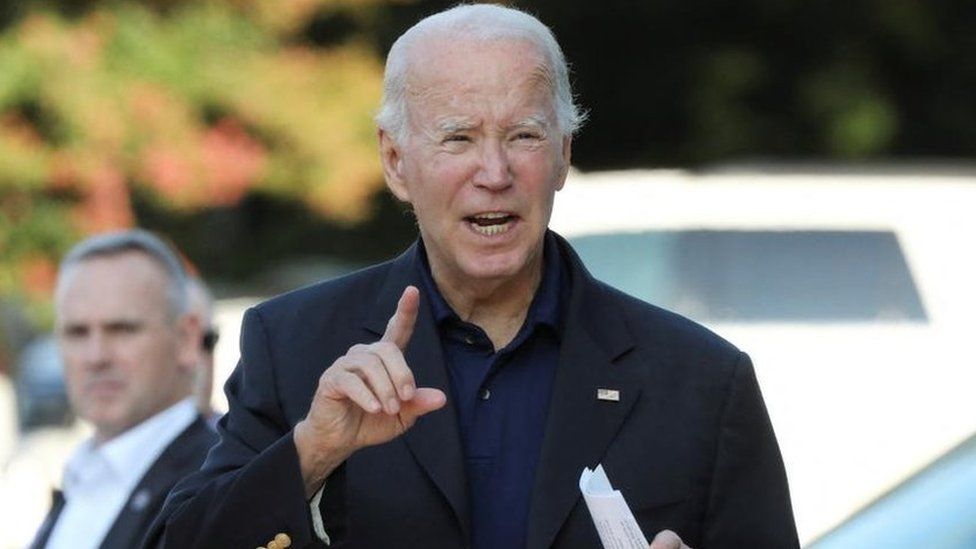

Bounleua Sinxayvoravong, government of the BoL, said the engagement reflected a shared vision for local integration, economic growth and success. Operators of instant payment systems, including the National ITMX Co and Lao National Payment Network Co ( LAPNet ), are among the participants in the initiative. Cross-border communities are handled by Kasikorn Bank and Banque Pour Le Commerce Exterieur Lao (BCEL). In the second phase, Krungthai Bank and Bank of Ayudhya in Thailand does offer the service for QR settlement in Laos. Six Laos businesses are already signed up.