Singapore Airlines to resume flights to 3 Chinese cities from Apr 22 after disruption due to ‘regulatory reasons’

SINGAPORE: Singapore Airlines (SIA) flights to Chongqing, Chengdu and Xiamen will resume from Apr 22, the national carrier said on Monday (Apr 1).

SIA will start with five times weekly flights from Apr 22 to Apr 28. Thereafter, it will be increased to daily services, the airline said in response to CNA’s queries.

The services will be suspended from Mar 31 to Apr 21 due to “regulatory reasons” an SIA spokesperson said without giving further detail. Before the suspension, SIA operated daily services to Chengdu and Xiamen, and three times weekly services to Chongqing.

Checks of SIA’s website showed that return flights to Chongqing are available from end-April until end-October, while those between Singapore and Chengdu are available from end-Apr to end-May. SIA flights operating between Singapore and Xiamen are also available from end-April to end-May.

The period of suspension follows a similar situation last year, when SIA flights into five cities, including Chengdu, Chongqing and Xiamen were halted. Services to these three cities resumed on Nov 26 last year.

According to SIA’s website, for the week of Apr 1 to Apr 7, the airline still offers a total of 70 flights from Singapore to four cities in mainland China: 35 to Shanghai, 14 to Beijing, 14 to Guangzhou and seven to Shenzhen.

Aviation analysts CNA spoke to suggested a few reasons for service disruptions, including capacity limits and the unavailability of flight slots.

POSSIBLE REASONS BEHIND DISRUPTION

Independent analyst Brendan Sobie said that the suspension might be because the carrier had not managed to obtain approval for the summer season, which runs from end-March to end-October, in time.

The analyst who founded aviation consultancy Sobie Aviation noted that the now-defunct SilkAir – which merged with SIA in 2021 – previously had the rights and slots to the affected routes, but that the slots could not simply be transferred to SIA.

“You need regulatory approvals from all countries to do these kinds of transfers. Different countries have different rules about this but China essentially requires a new application and doesn’t automatically approve any transfer of slots or rights from one airline to another,” he said.

As a result, SIA has had to obtain approvals from Chinese authorities. It managed to do so belatedly for the winter season last year, which runs from end-October to end-March. At that time, SIA did not sell seats on the affected routes beyond end-March, Mr Sobie stressed, adding that the regulatory issue had been going on “for a long time”.

According to Mr Sobie, slot approvals are not necessarily permanent.

“The old SilkAir slots were permanent but are now lost. So SIA Group has to try to get permanent slots for both summer and winter across all the former SilkAir routes.”

China is not the only authority to disallow transferring of slots. Changi Airport practises a similar policy, Mr Sobie pointed out.

“So to transfer you need to reapply, and you are essentially at the back of the queue. many airports don’t have available slots so it’s not easy unless you want to operate at really off-peak times like 2am,” said Mr Sobie.

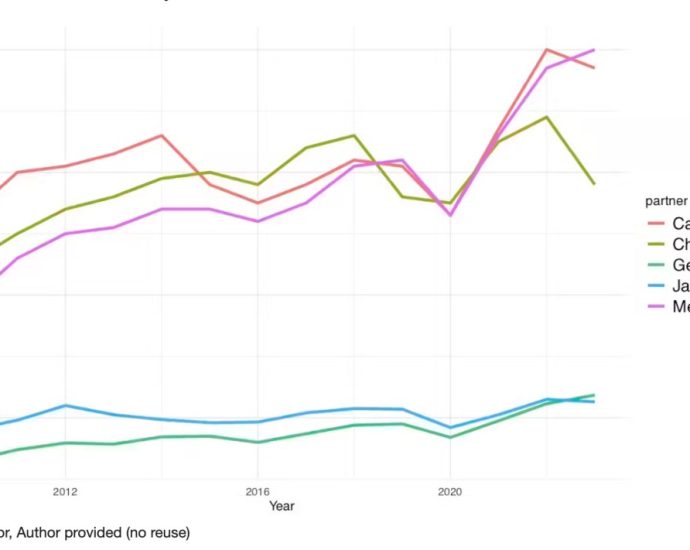

Agreeing with Mr Sobie’s assessment, transport analyst Terence Fan from the Singapore Management University (SMU) said that scheduled air passenger traffic in and out of China comes with more constraints compared to that of many other countries.

This is partly due to the heavy impact on China’s aviation sector during the pandemic, leading to China prioritising the recovery of their local airlines.

He said that in particular, airlines in the US have not been able to reinstate their pre-pandemic capacities as they had wished, and have had to adjust to new restrictions.