Kittirat mocks 10K critics

The economics archaeologists at PM’s assistant schools.

22 October 2023 at 04:02 PUBLISHED

The government’s distribution of a digital wallet worth 10,000 baht has sparked controversy, and the chief adviser to the prime minister referred to those who oppose it as” economics scientists.”

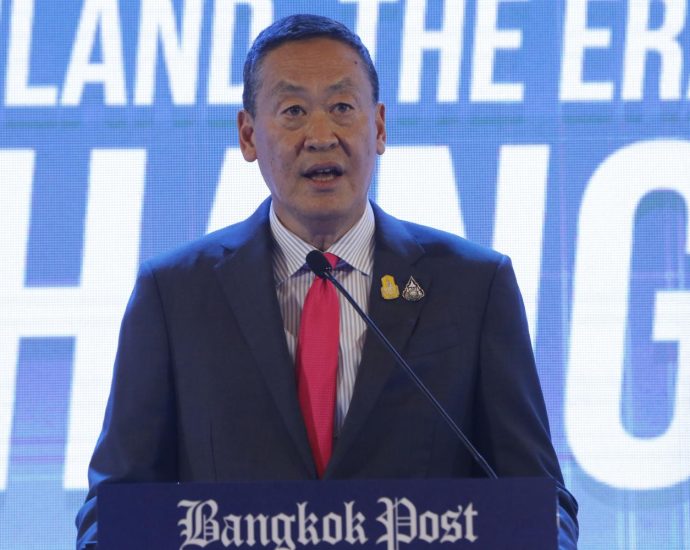

Former finance minister and current Prime Minister Srettha Thavisin assistant Kittirat Na Ranong stated on his Facebook section on Friday that the government is requesting assistance from businesses of all sizes and 56 million Thais.

He claimed it was pointless to put up with the quietly modest expansion that makes it difficult for recent graduates to find employment.

All I’m asking, he said, is for the 56 million of us, both rich and poor, to be intelligent cash purchases and make important purchases.

If the purchases were made directly in the towns, it would be even more beneficial.

The recipients of the digital wallet system, who must be at least 16 years old, may spend money at stores within four kilometers of their home where they have residence registration.

The government has insisted that the policy would unleash a tremendous amount of multiplying spending power, jolting the business out of its” weary” position.

However, detractors — many of whom are economists— have questioned the proposed policy’s transparency and demanded to know where the 560 billion baht estimated flagship scheme would be funded.

Mr. Kittirat allayed concerns that the plan would drive up consumer prices by claiming that buying might be more expensive due to stronger buying power.

He continued by saying that in order to prepare for the anticipated rise in purchasing power, the government was collaborating closely with all parties, including the private sector, to boost productivity and enhance the services sector.

He claimed that the plan may aid in removing the” trap of ignorance” brought on by the nation’s insistence that it maintain financial discipline at all costs.

In reality, the claim was made to placate loans of money who charge exorbitant interest rates when the national loan is lower than the home loan.

The financial impact of the purchasing power generated by the digital money scheme will be favorable for the survival of struggling companies.

Money that don’t perform will start to decline, and the work rate will be expected to increase.

People likely, in other words, be inspired by wish, he said.

It would depend on who spends the online money how much more of an economic roll the system would produce than what the” economics historians” had anticipated.

I want to help the PM morally on this statement, Mr. Kittirat said.