SC seeks to transform agri sector via fintech, alternative financing

Access to finance is critical to agriculture’s future, said SC chairman

Capital market could help Malaysia achieve its food security agenda

The Securities Commission Malaysia (SC) encourages the broader adoption of financial technology (fintech) in agriculture to help achieve the country’s food security agenda.

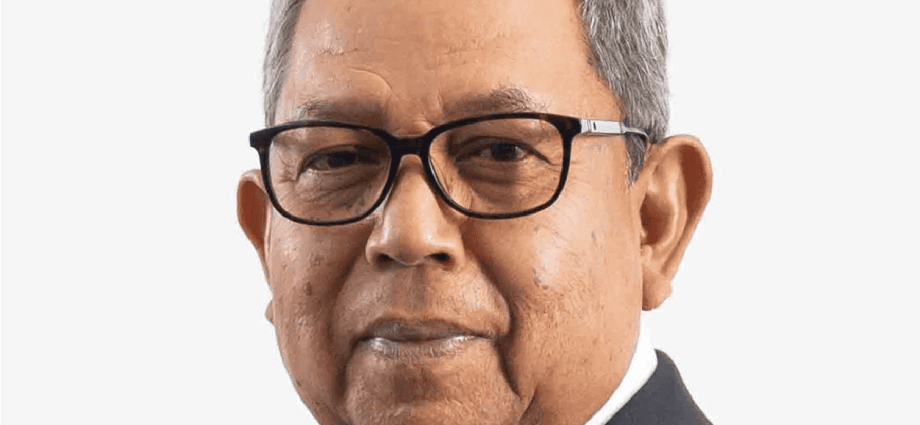

SC Chairman Awang Adek Hussin (pic) said access to finance…Continue Reading