Over the past few years there has been an expansion in the range of social elements being considered by investors and other stakeholders. Topics such as health and safety, diversity, worker’s rights, and human legal rights have become more central to sustainability techniques for a wide range of bond companies from corporates in order to sovereigns. This is getting supported by a more consistent and comprehensive reporting environment, legislation, and improved market standards.

Frameworks and standards addressing social issues include the UN Sustainable Development Objectives, the UN Guiding Principles on Business and Human Legal rights, and the International Work Organization’s Decent Function Principles. The latest write of the EU social taxonomy, published within February 2022, is a comprehensive approach to the role of interpersonal factors within a sustainable finance strategy. The particular draft taxonomy has three core goals: decent work; adequate living standards and wellbeing for end-users; and inclusive plus sustainable communities plus societies.

The third goal considers land, local and human rights as well as access to simple infrastructure. The suggestion also links an entity’s social effect to operating and capital expenditure, and turnover.

Economic activity that involves land-use modifications, resource extraction, considerable construction or the supply of essential services entail the greatest exposure to community-related credit risk. In some sectors, for example extractive industries, businesses operate in politically sensitive regions due to the location of the sources, meaning that community problems can persist more than long periods of time. Community problems are most materials to entities in the energy, natural resources, utilities, healthcare, customer finance and facilities sectors within Fitch’s rated universe.

Social factors are shown within Fitch’s ESG Relevance Scores (ESG R. S. ), indicating the materiality and relevance associated with social risk elements on the credit rating result, on a scale of ‘1’ (irrelevant) to ‘5’ (a crucial rating driver). 5 general social issues are assessed under Fitch’s framework. These include: labour relations and practices, employee wellbeing, human rights, local community relations, access plus affordability, customer well being, and exposure to social impacts. Analyses are usually conducted to look at the particular interactions between a good issuer and its various stakeholders, both inside the entity and in the market, community and wider society.

Social risk within focus: community relationships

Community relationships can be a serious issue for entities in whose operations affect interpersonal goods and common resources. This can be appropriate for companies operating in extractive industrial sectors and energy, chemical substances, and commodity processing. If operations come with an adverse impact on water, air and ground quality, this can straight impact adjacent neighborhoods. It can also be relevant regarding local government public financing issuers, where neighborhood dissatisfaction with economic activities can put demographic and human being capital factors, or tax revenue in danger.

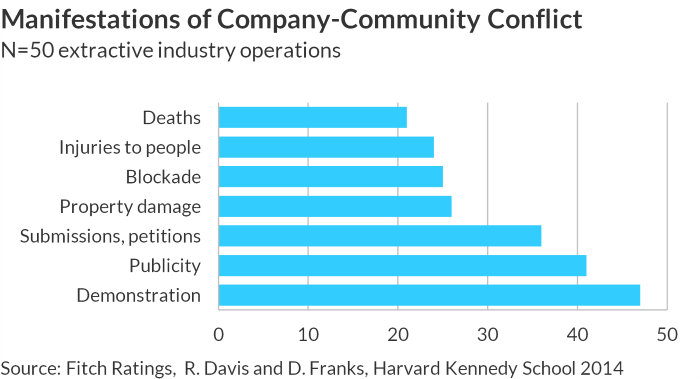

Failure to control community unrest can financially impact a good issuer. This may be brought on by higher resourcing requirements to address human rights-related issues – for example, for extra security or higher pay for workers to cross through protest zones – function stoppages, physical harm and violence, and also fines from infractions. A 2014 Harvard Kennedy School study of extractive-industry businesses that had experienced community problems estimated that production gaps at a major mining project with capex of US$3 billion-US$5 billion, cost an estimated US$20 million a week [1] . This did not include expenses associated with addressing negative publicity, repairing physical assets or responding to legal challenges.

Ongoing social turmoil in Peru led Fitch to review the ESG. RS of rated metals and mining companies in Apr 2022. Much of the disruption related to local communities’ unhappiness along with compensation, land, and resource access. Fitch has not yet used any rating activity, but it could location an elevated social meaning score if analysts believe the unrest will affect the extensive development plans associated with rated issuers plus impact credit quality. The Peruvian federal government declared a state associated with emergency in 04 2022 and the towns agreed to lift the particular blockade and created a supervised conversation with the miners.

Read the full are accountable to learn more

Contact

Aaron Wei

Director, ESG and Sustainable Finance

Business and Relationship Management

Fitch Rankings

E: [email protected]

[1] Costs of Company-Community Conflict in the Extractive Sector, Davis Rachel and Daniel M. Franks, Business Social Responsibility Effort Report No . sixty six, Harvard Kennedy College, 2014.

¬ Haymarket Media Limited. All rights reserved.