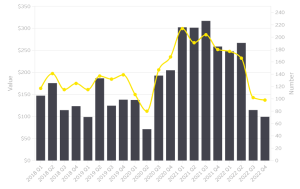

US private equity firms funded a scant $100 billion in new deals during 2022’s fourth quarter, barely more than a third of the 2021 peak, the website EY.com reported. The trade group blamed “lingering impacts of the Covid-19 pandemic, rising interest rates at home, and conflicts abroad” for the poor showing.

Private equity commitments in Q4 2022 fall to a third of peak

“The pace and scale of deals in private equity began to show cracks in late summer in the face of rising interest rates that dragged on company valuations and multiples,” Pitchbook.com wrote in a recent commentary. “By Q4, the total value of US PE deals was down nearly 42% from the all-time high reached in Q4 2021, while the number of deals dropped 23% year-over-year.”

Deloitte wrote in its 2023 renewable energy outlook that green energy investments fell “due to rising costs and project delays driven by supply chain disruption, trade policy uncertainty, inflation, increasing interest rates and interconnection delays. Many of these challenges will likely carry over into 2023, creating strong headwinds.”

Despite the global downtrend, some projects attracted unprecedented levels of investor interest. An ambitious new energy startup, Giga Carbon Neutrality, reported a US$500 million capital commitment from GEM Global Yield LLC SCS (GEM), the Luxembourg based private equity investment group, in the form of a share subscription facility (SSF).

GEM is a long-established private equity firm with $3.4 billion in assets. GCN on February 7 announced the GEM share subscription facility for up to $500 million of the company’s stock.

More or less simultaneously, GEM, according to Reuters, said on Friday, February 3, that it had increased its stake in Zurich-listed Swiss asset manager GAM (GAMH.S) from 3.3% to 5%, making it a major GAM investor.

GAM (Global Asset Management) is a major Swiss asset management company originally founded by UBS, but later spun off as a separately listed entity.

GAM said last week that it expects to report a net loss of approximately 309.9 million Swiss francs ($338.28 million) for the full year 2022, after experiencing negative asset flows. Its shares fell by 10% after the profit warning.

Bloomberg reported in July 2022 that GAM Holding AG is once more exploring a potential sale after the fund manager’s previous attempts to find a buyer stalled. That sales effort came to nought, but Sky News said recently that GAM, which has assets under management of approximately CHF74.5bn, is now working with bankers at UBS to field interest from prospective bidders. Shares in GAM are more than 30% lower than this time last year. On February 3, GAM had a market capitalization of just CHF129m.

A review of GEM’s recent capital commitments as reported by Pitchbook indicates that the Giga Carbon Neutrality investment is the venture firm’s largest commitment to date and demonstrates its high degree of confidence in GCN.

GCN seeks to combine alternative-energy vehicle manufacturing with V2X (vehicle-connected to everything) and internet of things systems, with the ambitious goal of “becoming a total solution provider including vehicle equipment manufacturing, comprehensive technologies, operation platforms, energy data and carbon credit services,” according to the company’s February 7 press release.